1366 E 15th St, Edmond, OK 73013

Tel: (405) 340-1717 Fax: (405) 340-6091

Email: greg@womackadvisers.com

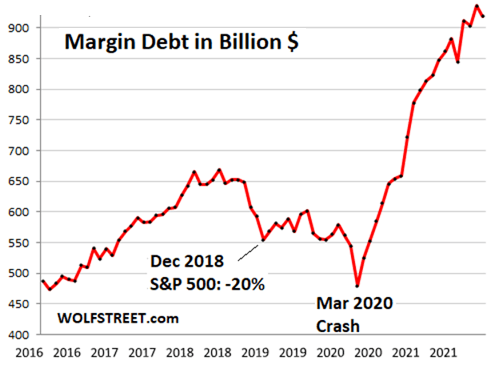

Margin Debt Balloons Over the Past 20 Months

Borrowing money to buy stocks adds buying pressure during a move up, but can be catastrophic on the way down. One of the worst phrases a trader will ever hear is ‘margin call’—when a broker demands more cash to cover a losing position or else have it forcibly liquidated.

In down markets, these forced liquidations contribute to the crashes that often occur near bottoms. Adding to the alarm bells already ringing, margin debt for the overall market - the amount of money investors have borrowed to buy stocks - has ballooned over the past 20 months. Despite the slight downtick of $17 billion in November, margin debt remains at a gargantuan $918.6 billion.

Womack Investment Advisers, Inc. (WIA) is a registered investment adviser whose principal office is located in Oklahoma. Womack Investment Advisers, Inc. is also registered in the State of California, the State of Illinois, the State of Indiana, and the State of Texas. WIA only transacts business in sates where it is properly registered, or excluded, or exempted from registration requirements.

The Legal Stuff

Useful Links

Contact info

Get Our Weekly Newsletter!

Contact Us

Thanks! You'll start receiving our valuable newsletter to your inbox weekly!

Please try again later